Real estate experts agree that the single most important consideration for getting your home sold when it hits the market is to price your home to sell especially for its condition. Aside from being in line with the price of similar homes in the area, the sale price can’t be too high or too low, it should be priced for online searches, and it needs to be set with psychology in mind. Many factors go into determining the right target price. So here are our tips (some with a bit different take on pricing) on how to price your house to sell in Kansas City.

1. Stand Objectively in the Buyer’s Shoes

It’s often difficult to do, but to price your house to sell in Kansas City, Lawrence, or Topeka you simply have to be objective and set aside your emotional attachment to your home. Even though you only care about your home, you’ll want to consider what other home options and properties buyers are seeing available to them and what their dollar will buy. This will allow you to more easily, when you run the comps, price according to what comparable homes are selling for, rather than pricing subjectively on the basis of your attachment. Work with your Seniors Real Estate Specialist® who has access to professional home selling data & market analytics that will be crucial in establishing your target list price for your goals.

2. Price Outside the Band

Most of the time, prices for comparable homes in an area will tend to bunch up or “band.” For example, homes like yours may all be priced between $184,000 and $187,000. You could, then, price your house to sell at $190,000 because that price is open will make your house stand out from the crowd so long as your home is elevated in features that warrant a higher price point. In recent years of a heavy seller’s market that was a challenge to aspiring buyers – sellers could get away with attracting buyers with an overpriced home simply due to inventory shortages. With movement towards a more balanced market, buyers are being much more choosy because they have more choices to pick from and they want to get a good value for their purchase. Pricing outside the band can be an effective strategy, so long as you aren’t overpriced causing your home to sit and become stale on the market.

3. Learn From Others’ Mistakes

Before settling on a sale price, take a look at houses that have recently sold in your immediate area, looking carefully at original list prices and actual, final sale prices. Work with your Seniors Real Estate Specialist® who has access to this professional market data for your area. Paying close attention to the final sale price is going to be very important as this information will hold heavy weight with appraisers that may be a part of your home sale. What you want to note is how many price cuts and how big a price cut it took for the owner to sell a home. The idea here is to learn from these pricing mistakes and not repeat them.

4. Avoid Century Pricing

This is a tip to help you price your house to sell, especially when downsizing in Kansas City that draws on a well-established pricing tactic, one you see in retail stores all the time. It’s simple and it works – don’t price in “0’s” (centuries). When you go to the grocery store or to that big discount store, you never see items priced at $5 or $10. Nope, those items will be $4.99 or $9.95. Even though there’s only a difference of a penny or so, the items seem to be much cheaper. And sometimes the psychology of perception is everything. So you wouldn’t, for example, price your house at $200,000. You would, instead, price it at $199,999 or $198,599. Our brains are used to this style of pricing and we often replicate it in real estate sales as well.

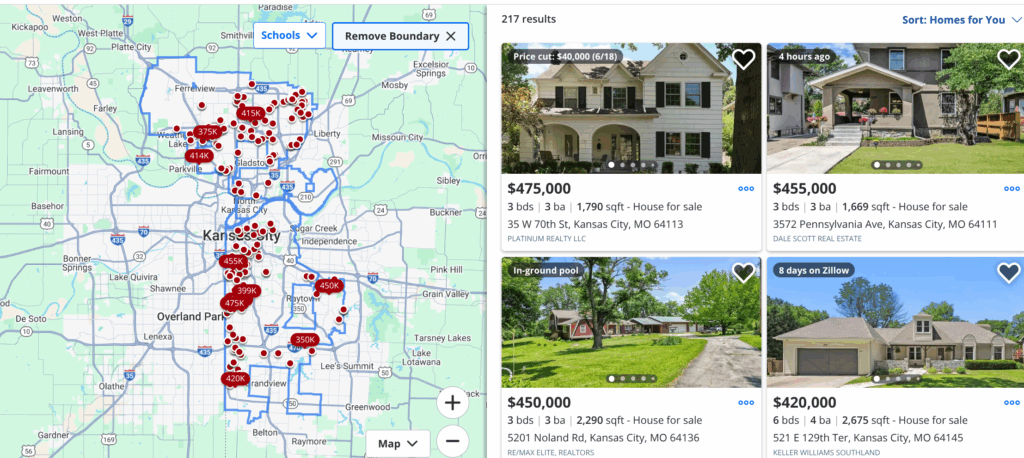

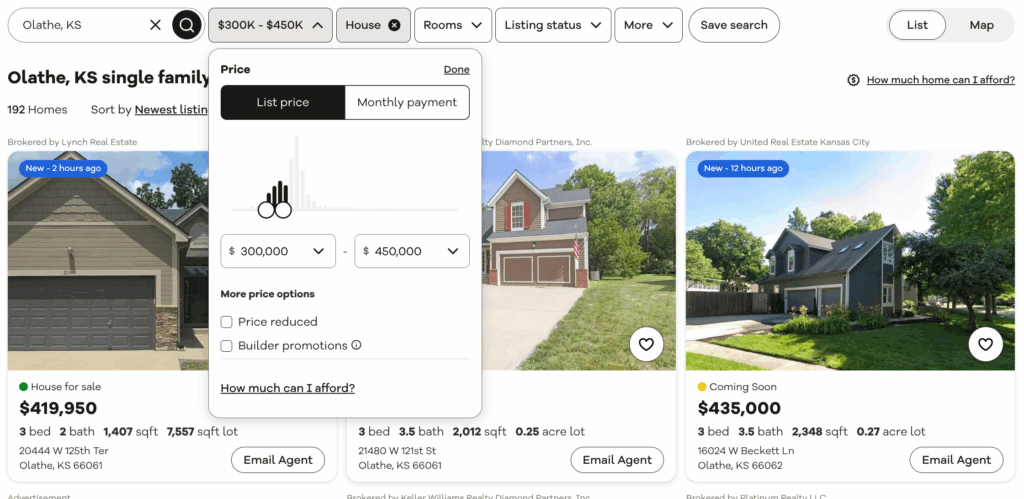

5. Price for Online Searches

Many people today begin their house hunting online, so your pricing has to take that fact into account as well. Your pricing strategy, then, should reflect the search parameters, especially the price range, that online house hunters use. Most people will search online within a price range from lowest to highest acceptable prices like $175,000 to $200,000. And if you set your price outside that range, say, at $170,000 or $205,000, searchers will never see your listing. Too low is just as bad as too high here, but $199,999 would fall within the search range and still be within a dollar of the maximum.

6. Do Your Own CMA

And just as an agent would, you should perform a comparative market analysis. Although you won’t have access to all the tools an agent would, you can still get a good idea of the market value of your home. Just be sure to look at homes with square footage and amenities close to what yours has, about the same age, listed within the past three months, and no farther away than about half a mile. Be very realistic about the level of finishes your home has compared to others in your area (ex: hardwood floors, solid surface countertops, updated kitchen, original carpet. Buyers will pay attention to these features as they consider homes.

There’s a lot you can do on your own to price your house to sell in greater Kansas City, but using a qualified local real estate Seniors Real Estate Specialist® will usually mean better and faster results. A local agent can help with optimum pricing because she’ll likely know about sales in the area/neighborhood that is in progress, but not yet on public record.